Retirement planning is a crucial process that everyone should consider regardless of their age. It involves setting up financial goals and creating a plan to achieve them so that you can enjoy your retirement years without worrying about money. Retirement planning can help you save money, invest wisely, and make informed decisions about your future.

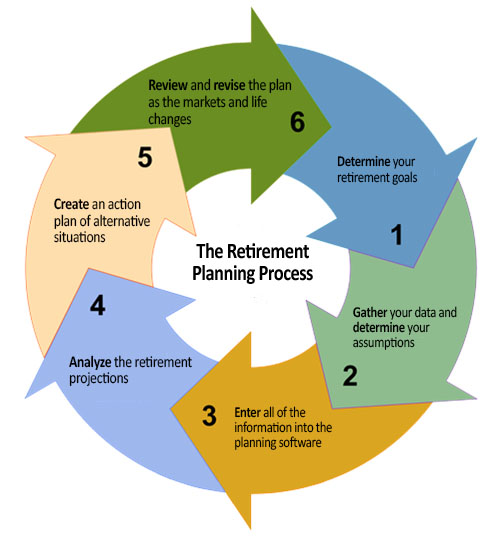

One of the first steps in retirement planning is determining your retirement goals. This includes deciding what age you want to retire, how much money you will need to live on during retirement, and what kind of lifestyle you want to have. Once you have determined your goals, the next step is creating a plan to achieve them.

Retirement options include pensions, 401(k)s, IRAs, annuities, and other savings plans. Each option has its own advantages and disadvantages depending on your specific needs and goals. A financial adviser can help you create a retirement plan that fits your unique situation.

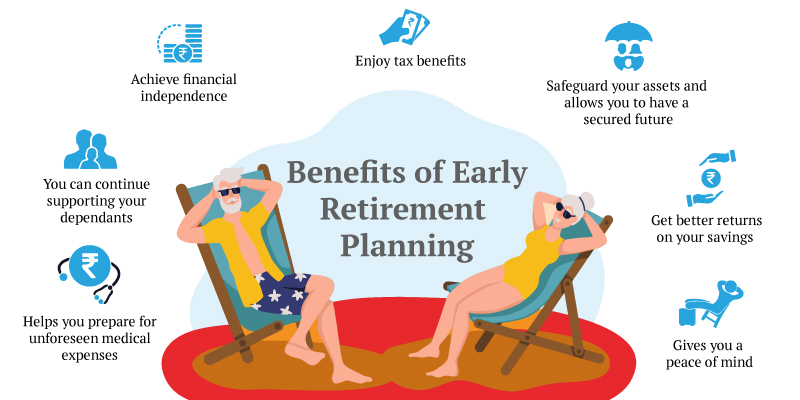

Benefits of retirement planning include financial security, peace of mind, and the ability to enjoy your retirement years without worrying about money. With proper planning and saving, you can ensure that you have enough money to cover all of your expenses during retirement.

There are also other schemes available such as equity release plans or term assurance policies which may be useful for some individuals depending on their circumstances.

Why Retirement Planning is Important: Take Control of Your Retirement Planning

Retirement Planning Helps You Take Control of Your Future Financial Security

Retirement planning is a crucial aspect of financial planning that helps you take control of your future financial security. It involves creating a strategy for saving and investing money to support yourself during retirement. Without proper planning, you may not have enough money to support yourself during retirement, which can lead to financial stress and hardship in your golden years.

Starting Early Can Help You Achieve Your Retirement Goals

One of the most important aspects of retirement planning is starting early. The earlier you start saving and investing for retirement, the more time your money has to grow. This means that even small contributions made early on can have a significant impact on your future financial security.

Having a Solid Retirement Plan Can Help You Enjoy a Comfortable Lifestyle

Another benefit of retirement planning is that it can help you achieve your retirement goals and enjoy a comfortable lifestyle in your golden years. By creating a solid retirement plan, you can determine how much money you will need to save and invest each year to reach your desired level of income during retirement.

Social Proofs: Statistics That Show the Importance of Retirement Planning

According to recent statistics from the National Institute on Retirement Security (NIRS), 66% of working Americans between the ages of 21 and 64 have no retirement savings at all. Additionally, only 4 in 10 workers have access to workplace retirement plans like 401(k)s or pensions. These statistics highlight the importance of taking control of your own retirement planning.

Examples: How Retirement Planning Can Impact Your Future Financial Security

Let's consider an example: John is currently 30 years old and wants to retire at age 65 with an annual income of $50,000 per year. Assuming he lives until age 85, he will need approximately $1 million saved for his retirement years. If John starts saving $500 per month at age 30 with an average annual return rate of 7%, he will have approximately $1.2 million saved by age 65.

On the other hand, if John waits until age 40 to start saving for retirement and saves the same amount per month with the same return rate, he will only have approximately $500,000 saved by age 65. This means that starting early can make a significant difference in your future financial security during retirement.

Life in Retirement and Steps to Prepare for Later Life

Plan Your Retirement Lifestyle

Retirement is a time to enjoy the fruits of your labor and indulge in activities that you may not have had the time or resources for during your working years. However, it's important to plan ahead and consider how you want to spend your time in retirement. This could include travel, hobbies, or volunteering.

Traveling can be an excellent way to explore new places and cultures. Whether it's a road trip across the country or a trip abroad, traveling can provide opportunities for adventure and new experiences. Hobbies such as gardening, painting, or playing an instrument can also be great ways to stay engaged and active in retirement.

Volunteering is another way to stay involved in your community while making a positive impact. Consider volunteering at a local hospital, animal shelter, or food bank. Not only will you be helping others but it can also provide a sense of purpose and fulfillment.

Think About Your Later Life

It's important to consider potential challenges you may face as you age when planning for retirement lifestyle. Health issues such as chronic illnesses or changes in mobility can affect your ability to live independently. Planning ahead can help you prepare for these challenges.

One way to prepare is by creating an advance directive which outlines your medical wishes should you become unable to make decisions for yourself. It's also important to consider long-term care insurance which can help cover expenses associated with assisted living facilities or nursing homes.

Consider Your Future Living Arrangements

Another aspect of preparing for later life is considering future living arrangements. Will you stay in your current home or downsize? Will you move closer to family or into a retirement community?

Staying in your current home may require modifications such as adding grab bars or wheelchair ramps if mobility becomes an issue. Downsizing may mean moving into a smaller home with fewer maintenance responsibilities.

Moving closer to family members can provide emotional support while also allowing them to assist with daily tasks if needed. Retirement communities can offer a variety of amenities and social opportunities, but it's important to research and visit multiple options before making a decision.

Create a Financial Plan

Creating a solid financial plan is crucial for retirement lifestyle. This includes saving for retirement through 401(k) plans or individual retirement accounts (IRAs), investing in stocks or mutual funds, and considering any other sources of income such as rental properties or Social Security benefits.

It's important to have a clear understanding of your expenses in retirement and adjust your budget accordingly. Working with a financial planner can help ensure that you're on track to meet your goals and can provide guidance as you navigate the complexities of retirement planning.

Stay Active and Engaged

Staying active and engaged in later life can improve both physical and mental health. Joining clubs or taking classes can provide opportunities for socialization while also learning new skills or hobbies.

Volunteering is another way to stay engaged while making a positive impact on others. Exercise is also crucial for maintaining physical health, whether it's through daily walks, yoga classes, or swimming.

Seek Professional Advice

Working with professionals such as financial planners or retirement specialists can provide valuable guidance throughout the retirement planning process. They can help ensure that you're on track to meet your goals while also providing insight into potential challenges you may face in later life.

Understanding Your Pension Options: Discover More About Pensions and Retirement

Defined Benefit Pensions: Understanding Your Pension Choices

Pensions are a critical part of retirement planning, and understanding your pension choices is essential to ensure a comfortable retirement. There are various types of pensions available, including defined benefit pensions, defined contribution pensions, and self-invested personal pensions (SIPPs). Each pension option has its advantages and disadvantages, and it's important to consider your individual circumstances before choosing a pension.

Defined benefit pensions are one type of pension that provides a guaranteed income in retirement based on factors such as salary and length of service. These types of pensions are typically offered by employers or government agencies. The amount you receive in retirement is predetermined by the formula used to calculate the pension benefits.

One advantage of defined benefit pensions is that they provide a predictable income stream in retirement. You don't have to worry about investment performance or market volatility affecting your income. Additionally, some defined benefit plans offer cost-of-living adjustments (COLAs) that can help protect against inflation.

However, there are also some drawbacks to defined benefit pensions. For example, you may not have control over how your contributions are invested, which means you may miss out on potential investment gains. Additionally, if you leave your employer before becoming vested in the plan (usually after five years), you may forfeit some or all of the benefits earned under the plan.

Defined Contribution Pensions: Investing in Your Future

Another type of pension is a defined contribution plan. Defined contribution plans allow employees to contribute pre-tax dollars into an account that is then invested in stocks, bonds, or other assets. The value of the account at retirement depends on how much was contributed and how well those investments performed over time.

One advantage of defined contribution plans is that they provide more flexibility than defined benefit plans if you leave your employer, you can typically roll over your account balance into another retirement account or take a lump sum distribution.

However, there are also some disadvantages to defined contribution plans. For example, investment performance is not guaranteed and can be affected by market volatility. Additionally, the responsibility for managing the investments falls on the employee rather than the employer or plan sponsor.

Self-Invested Personal Pensions (SIPPs): Taking Control of Your Retirement

A self-invested personal pension (SIPP) is another type of pension that allows individuals to take more control over their retirement savings. With a SIPP, you can choose from a wide range of investment options, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs).

One advantage of SIPPs is that they offer more flexibility than other types of pensions when it comes to investment choices. You have complete control over how your contributions are invested and can adjust your investments as needed based on changes in your financial situation or market conditions.

However, there are also some drawbacks to SIPPs. For example, they may not be suitable for everyone due to the higher level of risk involved with investing in individual securities. Additionally, fees associated with managing a SIPP can be higher than those associated with other types of pensions.

Pension Options: Annuities

Another option available within pensions is annuities. An annuity is an insurance product that provides a guaranteed income stream in retirement in exchange for a lump-sum payment or series of payments made over time. Annuities come in various forms and offer different features depending on the provider.

One advantage of annuities is that they provide a guaranteed income stream for life regardless of market conditions or investment performance. This can help provide peace of mind during retirement knowing that you will have a steady stream of income no matter what happens in the markets.

However, there are also some drawbacks to annuities. For example, they may not offer the same level of flexibility as other pension options. Once you purchase an annuity, you typically cannot change the terms or withdraw your funds without incurring penalties. Additionally, fees associated with purchasing and managing annuities can be higher than those associated with other types of pensions.

Reviewing Your Pension Options

It's important to review your pension options regularly to ensure they continue to meet your retirement goals and adjust them as necessary based on changes in your circumstances or financial situation. This includes reviewing investment performance, fees, and other factors that may impact the value of your pension benefits.

Pension Wise from MoneyHelper and Free Midlife MOT Course

MoneyHelper's Pension Wise service is an excellent resource for anyone who wants free and impartial guidance on retirement options. The service provides information on how to access your pension savings, tax implications, and the different types of pensions available. It is a great way to learn about your options and make informed decisions about your finances.

One important thing to consider when planning for retirement is managing debt. Age UK offers a free Midlife MOT course that can help individuals aged 40-74 assess their financial situation, plan for retirement, and make informed decisions about their money. This includes advice on managing debt, mortgages, and loans, as well as maximizing income through benefits and entitlements.

Taking a lump sum from your pension can provide a cash boost in retirement. However, it's important to consider the cost and tax implications before making any decisions. Pension Wise can help you understand how much money you can take out and the potential impact on your retirement income.

MoneyHelper is an organization that provides free advice and guidance on all aspects of personal finance. Their website is packed with useful information on topics such as budgeting, saving money, investing, insurance, mortgages, pensions, and more. They also have a helpline where you can speak to an expert advisor if you need further assistance.

Age UK's Midlife MOT course aims to help people in midlife take stock of their finances and plan for the future. The course covers a wide range of topics including health checks (such as blood pressure), work-life balance assessments (to identify stress levels), career development (including skills assessment), financial planning (including pensions), legal issues (such as wills), social connections (to reduce loneliness) and digital skills training (to improve online safety).

The course is designed to be accessible to everyone regardless of their financial situation or background. It's delivered by trained volunteers who are passionate about helping people get the most out of life in later years.

If you're considering taking a lump sum from your pension, it's important to understand the costs involved. The amount of tax you'll pay on the lump sum will depend on how much money you take out and your personal tax situation. Pension Wise can help you understand the potential impact on your retirement income and make informed decisions about your finances.

In addition to providing guidance on pensions, MoneyHelper also offers advice on managing debt. If you're struggling with debt, they can provide free advice and support to help you get back on track.

Managing debt is an important part of financial planning for retirement. Age UK's Midlife MOT course can help individuals assess their financial situation and develop a plan for managing debt. This may include consolidating debts, negotiating with creditors, or seeking professional advice.

When planning for retirement, it's important to consider all aspects of your finances including pensions, savings, investments, and debt. By using resources like MoneyHelper's Pension Wise service and Age UK's Midlife MOT course, you can make informed decisions about your finances and feel confident about your future.

Guidance from Pension Wise

Pension Wise: Your Guide to Retirement Planning

Planning for retirement can be a daunting task, especially when you consider the variety of pension options available. Fortunately, Pension Wise is here to help. This free and impartial guidance service provided by the UK government offers expert advice on all aspects of retirement planning.

Understanding Workplace Pensions

Workplace pensions are a common type of pension plan offered by employers. They are designed to provide employees with a source of income during their retirement years. Pension Wise offers guidance on how workplace pensions work, including information on contributions, investment options, and tax benefits.

Personal Pensions: A Flexible Option

If you're self-employed or your employer doesn't offer a workplace pension scheme, then personal pensions may be an option worth considering. These plans offer flexibility in terms of contributions and investment options. Pension Wise can help you understand the pros and cons of personal pensions and determine if they are right for you.

Defined Benefit vs Defined Contribution Pensions

Defined benefit pensions guarantee a specific amount of income during retirement based on factors such as salary and length of service. On the other hand, defined contribution pensions invest contributions made by both employees and employers into various funds that grow over time. The final value of these plans depends on the performance of these investments.

Pension Tax: What You Need to Know

Pension tax rules can be complex, but it's important to understand them in order to make informed decisions about your retirement savings. Pension Wise provides guidance on topics such as tax relief on contributions, lifetime allowance limits, and tax implications when accessing your pension pot.

State Pension: Your Entitlements

The state pension is a regular payment made by the government to eligible individuals who have reached state pension age (currently 66). Pension Wise offers guidance on how to calculate your entitlement based on your national insurance record and how deferring your state pension could increase its value.

One-on-One Appointments with Financial Advisers

In addition to online resources, Pension Wise offers one-on-one appointments with financial advisers who can provide tailored guidance based on your individual circumstances. These sessions are free and impartial, and can help you make informed decisions about your retirement options.

Making Sense of Retirement Planning

Retirement planning can be overwhelming, but seeking guidance from Pension Wise can help you navigate the complex world of pensions and tax rules. By understanding your options and entitlements, you can make informed decisions that will help secure your financial future.

Social Proof: The Benefits of Seeking Guidance from Pension Wise

According to a survey conducted by the UK government in 2020, 88% of individuals who used Pension Wise reported feeling more confident in their retirement planning after receiving guidance. Additionally, 94% felt that the information provided was clear and easy to understand.

Getting Professional Help and Advice

Many people feel overwhelmed and unsure of where to start. That's where a professional adviser can come in handy, providing impartial help and advice tailored to your specific needs and goals.

Finding the right adviser for you can take some research and effort. It's important to ask questions about their experience, qualifications, and services offered to ensure they are a good fit. One easy way to start your search is by visiting the government's website on retirement planning. This site offers helpful tips and resources for people at all stages of life.

Another option is to check with your employer to see if they offer retirement planning services as part of their benefits package. Many workplaces recognize the importance of helping employees plan for their future and may have resources available.

If you're looking for a more hands-on approach, consider opening an Individual Savings Account (ISA) specifically designed for retirement savings. These accounts can provide tax benefits and potentially higher returns than traditional savings accounts.

When working with an adviser or considering different ways to invest your retirement savings, it's important to understand the level of risk involved. There are many factors that can affect investment performance, including market fluctuations and economic conditions.

It's also important to make informed decisions based on your personal financial situation and goals. Don't be afraid to ask questions and seek out multiple opinions before making any major decisions, such as whether to invest in a lump sum or spread out contributions over time.

Ultimately, getting professional help and advice can be a good idea you can create a personalized plan that helps ensure financial security in your golden years.

Managing Your Money: Planning for Retirement at Different Ages and Near Retirement Age

Start Saving Early

One of the most important things you can do to plan for retirement is to start saving early. The earlier you start, the better off you'll be. Starting in your 20s or 30s gives you more time to save and allows your money to grow through compound interest. Even if you can only afford to save a small amount each month, it's better than nothing.

Adjust Your Savings as You Age

As you get older, it's important to adjust your savings plan to ensure you're on track for retirement. In your 40s and 50s, you may need to increase your contributions to catch up if you haven't saved enough. This is especially true if you've had a late start or have experienced financial setbacks such as job loss or illness.

Make the Most of Your Time

If you're nearing retirement age and haven't saved as much as you'd like, there are still steps you can take to improve your situation. Consider delaying retirement, working part-time in retirement, or downsizing your home to free up cash for retirement savings.

Delaying Retirement

Delaying retirement is one way to make the most of your time and improve your financial situation. If possible, consider working a few extra years before retiring. This will give you more time to save and allow your existing savings more time to grow.

Working Part-Time in Retirement

Another option is working part-time in retirement. Many retirees find that they miss the social interaction and intellectual stimulation that comes with work. Working part-time can also provide an additional source of income which can help stretch out your savings.

Downsizing Your Home

Finally, consider downsizing your home if it makes sense for your situation. A smaller home means lower mortgage payments, property taxes, and utility bills which frees up cash for retirement savings.

According to a recent survey by Bankrate.com, only 16% of Americans are very confident that they will have enough money saved for retirement. This is a concerning statistic, but it's not too late to take action. By starting early, adjusting your savings plan as you age, and making the most of your time, you can improve your financial situation and increase your chances of having a comfortable retirement.

According to the National Institute on Retirement Security, the median retirement account balance for working-age Americans is only $3,000. This is far below what most experts recommend for a comfortable retirement. However, by following some basic principles such as starting early and adjusting your savings plan as you age, you can improve your financial situation and increase your chances of having a comfortable retirement.

Step Two: Work Out Your Likely Retirement Income

Determine Your Expected Retirement Income Sources

When planning for retirement, it's essential to determine your expected retirement income sources. These sources include Social Security, pensions, and investments. Social Security is a significant source of retirement income for many Americans. It provides guaranteed income that you can rely on in retirement.

Pensions are another source of guaranteed income. If you have a pension plan through your employer, it's important to understand how much you can expect to receive in retirement. You can usually find this information on your annual pension statement or by contacting your plan administrator.

Investments are also an important source of retirement income. You may have savings in a 401(k), IRA, or other investment accounts that will provide regular income in retirement. It's important to estimate the amount of regular income you can generate from these accounts.

Calculate the Amount of Guaranteed Income You Will Receive

When calculating your expected retirement income, it's important to consider the amount of guaranteed income you will receive from sources like Social Security and pensions. For Social Security, you can use the online calculator provided by the Social Security Administration to estimate your benefits based on your earnings history.

For pensions, you should review your annual pension statement or contact your plan administrator for an estimate of your monthly benefit at retirement age. It's important to note that some pension plans offer different payout options that may affect the amount of monthly income you receive.

Estimate Regular Income from Retirement Savings and Investments

In addition to guaranteed sources of retirement income, it's important to estimate the regular income you can generate from your retirement savings and investments. This includes any withdrawals from 401(k)s, IRAs, or other investment accounts.

To estimate this amount accurately, you'll need to consider factors such as investment returns and withdrawal rates. A financial advisor can help you create a personalized plan based on your specific situation.

Consider Factors That May Affect Your Retirement Income

It's essential to consider factors that may affect your retirement income, such as inflation and changes in the economy. Inflation can erode the purchasing power of your retirement income over time. It's important to consider this when estimating your retirement income needs.

Changes in the economy can also impact your retirement income. For example, a recession could reduce investment returns and lower the value of your investment accounts. It's important to have a plan in place for dealing with these types of events.

Key Points for Successful Retirement Planning

Retirement planning is an essential part of life that should not be overlooked. It is important to take control of your retirement planning and prepare for later life. In this article, we have discussed the importance of retirement planning, steps to prepare for later life, understanding pension options, guidance from Pension Wise, getting professional help and advice, managing your money at different ages and near retirement age, and working out your likely retirement income. Here are some key points to remember when planning for a successful retirement:

Other Useful Links

Visit the Pension Calculator

Final Salary Pension

Investment advice

Retire Early

Always check our latest articles at...

https://banksandfinance.com/retirement-planning

BankingFinanceCryptoMortgagesRetirement PlanningEstate PlanningCredit CardsCredit RepairPrivacy PolicyTerms And Conditions

BankingFinanceCryptoMortgagesRetirement PlanningEstate PlanningCredit CardsCredit RepairPrivacy PolicyTerms And Conditions