As we age, it's natural to think about what we want to leave behind for our loved ones. Estate planning is a critical aspect of this process, as it helps seniors ensure that their wishes are carried out after they pass away. Beyond that, estate planning can offer peace of mind, minimize taxes, and simplify end-of-life planning for seniors and their families. By planning ahead, seniors can take control of their future and make informed decisions about their assets, healthcare, and legacy.

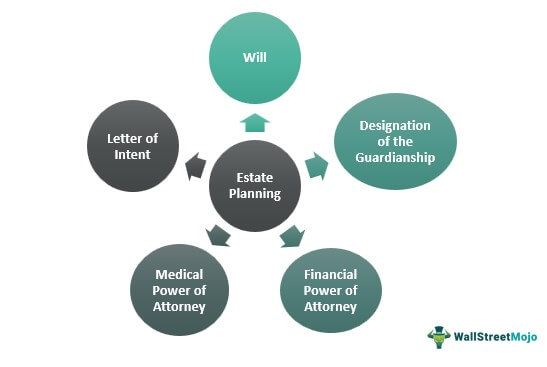

Estate planning for seniors involves several critical considerations, such as identifying assets, determining beneficiaries, and establishing legal documents.

This article will discuss the importance of estate planning for seniors, the assets that should be considered when planning an estate, and the legal documents and professional help available.

By the end of this article, seniors will have a better understanding of estate planning and the steps they can take to protect their assets and ensure a comfortable future for their loved ones.

Key Takeaways

- Estate planning is important for seniors to ensure their wishes are carried out after they pass away.

- Estate planning involves identifying assets, determining beneficiaries, and establishing legal documents.

- Estate planning can help minimize taxes and administrative costs.

- Professional guidance and assistance from a financial planner or estate attorney is crucial in estate planning.

Importance of Estate Planning

The importance of estate planning lies in its ability to simplify decisions for loved ones after death, minimize taxes, and assist with end-of-life planning. Estate planning involves considering tangible and intangible assets, debts, and other items, and utilizing legal documents such as wills and living trusts with the help of financial planners or estate attorneys.

One of the benefits of estate planning is that it ensures that a person's assets are distributed according to their wishes after their death. Without a proper plan in place, the state may have to intervene and distribute assets according to its own laws, which may not align with the deceased person's wishes.

Additionally, estate planning can help minimize taxes and administrative costs, leaving more for beneficiaries. Common misconceptions about estate planning include the idea that it is only for the wealthy or that it is only necessary for those with children. However, estate planning is important for everyone regardless of their financial situation or family status.

Assets to Consider

Tangible and intangible assets worth more than $100, real estate, vehicles, and debts are all important considerations when creating an effective estate plan.

It is important to inventory and photograph tangible assets, such as jewelry, antiques, and collectibles, to ensure proper distribution.

Intangible assets, such as 401k plans, brokerage accounts, and bank accounts, should also be accounted for and assigned a TOD beneficiary.

Real estate and vehicles should be included in the inventory, with clear instructions on how they should be distributed or sold.

Debts should also be monitored and listed to ensure they are paid off with the assets in the estate.

It is important to choose an estate administrator carefully, as they will be responsible for distributing assets and handling any legal issues that arise.

By considering all of these assets, seniors can create an effective estate plan that simplifies decisions for loved ones after their death and minimizes taxes if done properly.

Legal Documents and Professional Help

When considering the legal aspects of ensuring the proper distribution of assets after death, it is crucial to have professional guidance and assistance from a financial planner or estate attorney. These professionals can provide a wide range of services, including helping to navigate unexpected issues that may arise during the estate planning process and ensuring adequate protection from tax-related activities or insurance needs. They can also provide valuable advice on the different types of legal documents that can be used to ensure that your wishes are carried out after you pass away.

Two of the most important legal documents for estate planning are living wills and powers of attorney. A living will is a document that specifies your wishes regarding medical treatments and life-sustaining measures in the event that you become incapacitated and are unable to communicate your wishes.

A power of attorney, on the other hand, is a legal document that gives someone else the authority to act on your behalf if you are unable to do so yourself. Both of these documents are essential for seniors who want to ensure that their wishes are respected and that their assets are distributed according to their wishes after they pass away.

Frequently Asked Questions

How can charitable giving be incorporated into an estate plan?

Charitable giving can be incorporated into an estate plan through various methods, including a charitable trust or bequest in a will. Doing so can provide tax benefits for the estate and support a charitable cause.

Is it necessary to update after major life events, such as a divorce or the birth of a grandchild?

Updating estate planning documents is crucial after major life events, such as divorce or birth of a grandchild, to ensure proper inheritance distribution. Neglecting updates can result in unintended consequences and legal disputes.

What are the potential consequences of not having an estate plan in place?

Not having an estate plan can lead to financial insecurity and legal disputes among family members. Without clear instructions, assets may be distributed in unintended ways, and taxes and fees may reduce inheritance.

Can a person designate different beneficiaries for different assets in their estate plan?

Naming multiple beneficiaries in an estate plan is crucial, especially for blended families. A survey found that only 32% of people have updated their beneficiary designations post-divorce. Professional help can ensure proper planning for complex family situations.

How can a person ensure that their healthcare wishes are carried out if they become incapacitated?

To ensure healthcare wishes are carried out if incapacitated, individuals can create advance directives stating their preferences for medical treatment. They can also designate legal guardianship for healthcare decisions in case of incapacity.

8 Essential financial tips for young professionals

Introduction: Congratulations, young professional! You're entering an exciting phase of your life, full of possibilities and new opportunities. As you embark on this journey, it's crucial to establish a strong financial foundation that will pave the way for a secure and prosperous future. Money management might seem daunting, but fear not! In this article, we've compiled 8 essential financial tips tailored specifically for young professionals like yourself. These tips will not only help you navigate the financial landscape with confidence but also set you on the path to achieving your long-term goals. So, let's dive in and discover the keys to financial success!

Give Back and Practice Gratitude

Even while focusing on your financial journey, it's important to give back and practice gratitude. Donate to causes you care about, volunteer your time, or support local businesses. Cultivating a sense of gratitude and generosity not only benefits others but also enriches your own life. It reminds you of your abundance and fosters a positive mindset that can positively impact your financial well-being.

Pay off High-Interest Debt

Debt can be a heavy burden that hampers your financial progress. Start by tackling high-interest debt, such as credit card balances or private student loans. Paying off these debts quickly will save you money on interest payments in the long run. Consider using the avalanche or snowball method: either focus on paying off the debt with the highest interest rate first or start with the smallest balance. Whichever approach you choose, commit to making consistent payments and watch your debt shrink over time.

Protect Yourself with Insurance

Insurance is a crucial component of financial security. Make sure you have the appropriate insurance coverage to protect yourself from unexpected events. This includes health insurance, renter's or homeowner's insurance, auto insurance, and disability insurance. While paying for insurance may seem like an additional expense, it provides you with peace of mind and shields you from potentially devastating financial losses.

Practice Mindful Spending

Before making a purchase, practice mindful spending by asking yourself if it aligns with your values and priorities. Consider whether the item or experience will truly bring you happiness and long-term satisfaction. By pausing and reflecting on your spending decisions, you can avoid impulse purchases and focus on allocating your resources toward things that truly matter to you.

Take Advantage of Employer-Sponsored Benefits

In addition to your salary, your employer may offer other valuable benefits such as a flexible spending account (FSA), commuter benefits, or professional development opportunities. Take the time to familiarize yourself with these benefits and utilize them to their fullest extent. Whether it's using pre-tax dollars for healthcare expenses or participating in employer-matched retirement contributions, these benefits can save you money and support your financial goals.

Prioritize Self-Care

Taking care of your physical and mental well-being is essential not only for your overall happiness but also for your financial success. Prioritize self-care by making time for exercise, healthy eating, and stress reduction activities. Investing in your well-being now can prevent costly health issues down the road and ensure you have the energy and focus to excel in your career. Remember, your financial well-being is interconnected with your overall well-being.

Start Saving for Retirement Early

Retirement might seem light-years away, but time is your greatest ally when it comes to building wealth for your golden years. Take advantage of compound interest by starting to save for retirement as early as possible. Even small contributions can now grow into a substantial nest egg over time. Consider contributing to an employer-sponsored 401(k) or opening an individual retirement account (IRA). Automate your contributions so that a portion of your salary goes directly into your retirement savings without you even realizing it.

Plan for Major Expenses

Life is filled with major expenses like buying a car, purchasing a home, or starting a family. It's important to plan for these milestones in advance to avoid financial strain. Start saving early, do thorough research, and create a realistic timeline for each major expense. By being proactive and strategic, you'll be better prepared and can make these important life decisions with confidence.

As a young professional, implementing these 8 essential financial tips will set you on a path to financial success and empower you to make informed decisions. Building financial stability takes time and discipline, but the rewards are worth it. Embrace these tips, learn from your experiences, and stay committed to your long-term financial goals. With the right mindset and habits, you'll navigate the financial landscape with confidence and create a brighter future for yourself.

Frequently Asked Questions

How much should I save for an emergency fund?

Ideally, you should aim to save at least three to six months' worth of living expenses in your emergency fund. This amount will provide you with a financial cushion to cover unexpected expenses, such as medical emergencies or job loss, without relying on credit cards or loans. However, the exact amount you need may vary based on your monthly expenses, job stability, and circumstances. Assess your situation and determine what would give you a sense of security and peace of mind. Start by setting small, achievable goals and gradually build your emergency fund over time.

How can I negotiate my salary effectively?

Negotiating your salary can be intimidating, but you can increase your earning potential with the right approach. Start by doing thorough research on salary ranges for your position and industry. Understand your market value based on your skills, experience and the value you bring to the organization. Practice articulating your achievements and skills confidently during the negotiation process. Emphasize your value to the company and highlight any unique qualifications or accomplishments. Be prepared to compromise and consider alternative requests, such as additional vacation days or professional development opportunities. Remember, negotiation is a conversation, and both parties should benefit. Stay confident, professional, and advocate for your worth.

How can I avoid lifestyle inflation?

Lifestyle inflation occurs when your expenses rise in proportion to your income. To avoid this, it's important to be mindful of your spending and prioritize your financial goals. Resist the temptation to upgrade your lifestyle with every raise or promotion. Instead, focus on maintaining a modest lifestyle and allocating any extra income towards savings, investments, or debt repayment. Regularly review your budget, track your expenses, and question whether each purchase aligns with your values and long-term objectives. By being conscious of your spending habits and staying disciplined, you can prevent lifestyle inflation and make more meaningful progress toward your financial goals.

How often should I review my financial plan?

Reviewing your financial plan at least once a year or whenever there are significant changes in your life or financial circumstances is recommended. Major life events like a career change, marriage, buying a home, or having children may necessitate adjustments to your financial plan. Additionally, regular check-ins allow you to track your progress, reassess your goals, and make any necessary course corrections. Stay proactive and adaptive to ensure your financial plan aligns with your current needs and aspirations.

Why is giving back important for my financial well-being?

Giving back and practicing gratitude positively impact your overall well-being, including your financial well-being. Engaging in charitable activities or supporting causes you care about fosters a sense of purpose and fulfillment. It reminds you of the abundance in your life and cultivates a positive mindset. By practicing gratitude and giving back, you develop a healthy relationship with money, recognizing its potential to create positive change in the world. Moreover, it strengthens your connections with others, expands your network, and opens up opportunities for collaboration and growth. Ultimately, a well-rounded and fulfilled life contributes to your overall financial well-being.

Always check our latest articles at...

https://banksandfinance.com/estate-planning

BankingFinanceCryptoMortgagesRetirement PlanningEstate PlanningCredit CardsCredit RepairPrivacy PolicyTerms And Conditions

BankingFinanceCryptoMortgagesRetirement PlanningEstate PlanningCredit CardsCredit RepairPrivacy PolicyTerms And Conditions